Major Benefits of Supply Chain Finance for Buyers and Suppliers

Businesses seeking to optimize cash flow sometimes postpone payments to suppliers, sometimes for longer periods than suppliers can bear. According to research cited in The Economist, this issue affects 47% of suppliers polled. It’s easy to understand how this approach might cause conflict between suppliers and buyers if left uncontrolled.

The way businesses and suppliers engage has changed dramatically as a result of supply chain financing. It has not only facilitated the funding process, but it has also assured that both parties can conduct business effectively and efficiently. However, before we can realize how it has unlocked various advantages, we must first understand what supply chain finance genuinely includes.

An Introduction to Supply Chain Financing

Supply Chain Financing, or SCF, is a technology-based financing solution that connects buyers and sellers and facilitates commercial transactions. It has grown in popularity in recent years and has had a favorable influence on commercial transactions between suppliers and corporations, making them more efficient. Not only that, but it also offers a simple method of company financing.

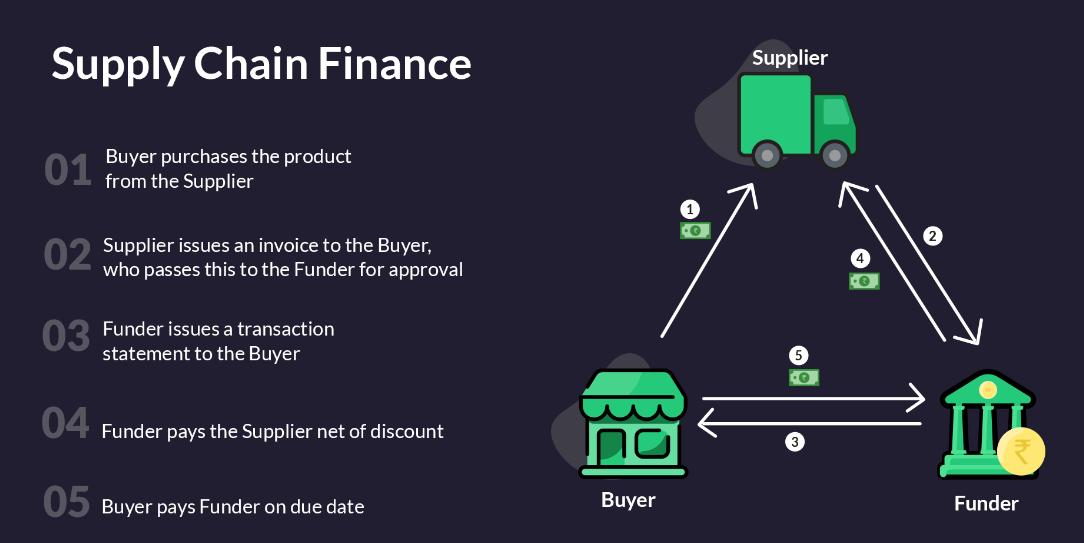

In a supply chain, the buyer, the seller, and the financing institution are the main participants. The customer buys a package of products from the supplier and pledges to pay them off at a defined expiration, which is generally between 30 and 60 days. If the suppliers need to be paid sooner, they can request quick payment for the invoice accepted by the customer.

What is the function of supply chain finance?

Technology is used in the SCF financing approach to automate every step of the transaction, from invoice approval to payment. The supplier, the corporate customer, and the financial institution are the three partners that make up the system.

The procedure begins when a corporate buyer makes a purchase of goods or products from a supplier and makes a payment commitment of 30 to 60 days. To manage their working capital needs, suppliers all strive for a payment cycle that is as short as feasible. If the corporations have authorized the invoices in certain circumstances, they might get immediate payment for the invoice they produced.

Buyer Benefits from Supply Chain

This type of financial supply chain management benefits consumers in several ways. The buyer can: Because the credit period is longer, he or she can:

- Reduces working capital investment to the absolute minimum

- Automation lowers the cost of administration.

- Lowers the total cost of borrowing

- Increases the corporate credit rating

- Enhances working capital and provides beneficial cash impacts

- Increased cash and improved credit rating

Supply Chain Advantages for Suppliers

Early payment options seem to be the sole benefit that stands out for suppliers. However, aside from this, they are successful because they can:

- Cuts the working capital cycle in half

- Decreases the total amount of unpaid bills

- Enjoy the advantages of reduced borrowing rates

- Increase in cash flow

- Leverages the buyer’s credit rating to lower borrowing costs Reduces pending debt

- Get enticing lending rates

- Lower costs for funding

- Make judgment-free choices.

- Boost performance

Some other important advantages to mention

- The buyer has the option to extend payment terms: The excellent part is that purchasers may extend payment terms if necessary, giving them a lot more flexibility while running a business.

- The supplier is in charge of the cash flow: Suppliers have a lot more options when it comes to being paid now that channel financing is being employed. They can easily anticipate when that will occur, and because the supplier is getting paid faster than usual, they can invest in the company and remain operational.

- Suppliers benefit from cheaper financing rates: Suppliers can obtain a substantially cheaper interest rate through supply chain finance than they would otherwise. The advantage of supply chain finance is that the buyer is generally a much larger company with a much better credit rating.

- Solid connections between the buyer and the provider: Each partner is invested in the success of the other and an entire relationship’s success. It is in the buyer’s best interest to avoid losing their smaller suppliers, thus they will do anything they can to assist them so that they do not go out of business.

Summing Up!

In a world where international firms face tough competition, supply chain financing provides a safe, cooperative, and smart approach to ensure that everyone participating in the process benefits. It’s not merely a win-win situation for customers and providers. It is a victory for both their company and their customers!

With GST about to go into effect shortly, different levels of the supply chain will be subject to different tax slabs, whilst certain supply chain components will profit and be allowed to move around more freely. Once the GST is implemented, the supply chain’s primary focus will be on logistical costs and customer service.

Go to Homepage